India’s Prime Minister Narendra Modi announced on November 9, 2016, that 500 and 1000 rupee notes would be taken out of circulation in an effort to reduce corruption, terrorism, black money and counterfeiting, and will no longer be accepted as legal tender in India. His surprise announcement caused chaos in the country as citizens scrambled to adjust to a new monetary norm that banned about 85 percent of cash in circulation.

This move was meant to bring billions of dollars worth of unaccounted money back into India’s economy. The Indian economy has thus far run primarily on cash transactions. This, in turn, has left a substantial proportion of India’s national income unaccounted for, as it doesn’t fall into the tax net. According to a research note by Ambit Capital Research, the size of India’s untaxed black market economy is worth $460 billion. In a “cashless” India, financial transactions will be more easily traceable, and previously unaccounted transactions will not fall through the net of the tax authorities.

The demonetization of the two highest-denomination notes in India has led to an increase in the use of electronic payment services and is a big step toward a cashless society. This, in turn, has two key benefactors: e-money payment companies and bitcoin.

E-Money Stocks Are Rallying

As reported by Bloomberg, e-money stocks have soared since Prime Minister Modi announced that he wants India to become a cashless society. India’s publicly listed electronic cash companies’ stock prices have surged in the wake of the currency reform in November. They are expected to continue to outperform since the government has introduced a range of discounts for making digital instead of cash payments.

Of the 23 e-payment solutions companies listed on India’s National Stock Exchange, 5 have been key outperformers since the new currency reform.

The stock prices of e-commerce software developers Intense Technologies Ltd. and Vedavaag Systems Ltd. increased by over 50 percent, while e-payment service provider RS Software India Ltd., technology solutions provider Aurionpro Solutions Ltd. and telecom solutions provider Tanla Solutions Ltd. have all rallied by over 20 percent.

On the day after the announcement, Credit Suisse Singapore made a strategic investment in Vakrangee Ltd., which provides digital financial services to governments and lenders, by buying 3.83 million shares in the firm and thereby signaling that it is prepared to bet on the profitable future of this sector in India.

A. K. Prabhakar, Head of Research at IDBI Capital in Mumbai, told Bloomberg that his team expects “double-digit revenues growth for e-governance firms over the next 3 to 4 years if the government systematically encourages cashless transactions” and that “growth in digital modes of payments will continue to be strong if the safety is increased and charges are reduced.”

According to the Reserve Bank of India, digital payments have increased by almost 50 percent from November to December, which shows that the shift toward a cashless economy is happening despite initial chaos in the country. This development will bode well for e-payment solutions providers and mobile money services.

Bitcoin Is Booming in India

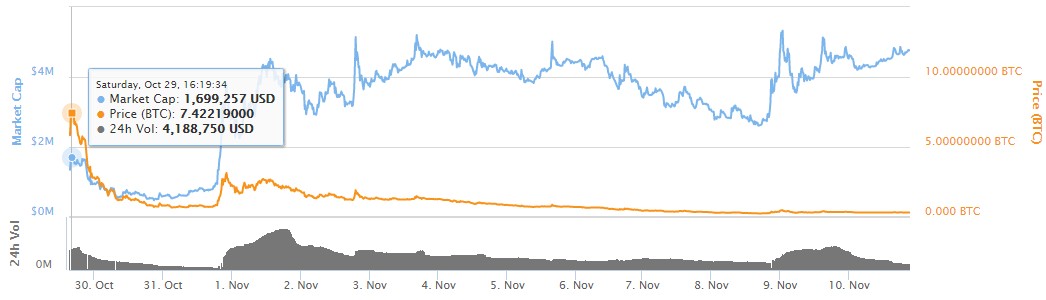

India’s aggressive move toward becoming a cashless society, however, is not only benefiting e-money companies.It has also created a boom for bitcoin in the world’s seventh largest economy.

According to data compiled by Coin Dance, trading volumes at peer-to-peer bitcoin exchange LocalBitcoins has spiked aggressively in India since November 9, while leading Indian bitcoin exchanges Zebpay, Unocoin and Coinsecure are witnessing a surge of new users coming onto their platform to exchange rupees for bitcoins.

According to Zebpay Co-Founder Saurabh Agarwal, Zebpay’s trade volumes have increased by 25 percent from October to November; they have had 50,000 new users sign up to their exchange in the month of November alone, well above the usual 20,000 new-user increases they have experienced in previous months.

Coinsecure experienced a 300 percent increase in user sign-ups in November, while Unocoin had their user base increase threefold in the wake of India’s currency reform.

While bitcoin merchant adoption is still next to none in India, the new currency reform and the subsequent push toward digital payments will give bitcoin a boost as a means of making online payments. More merchant adoption will also lead to more individuals adopting the digital currency, which, in turn, will help bitcoin flourish in India’s future cashless society.

Written by Alex Lielacher for the Bitcoin Magazine | Original article: https://bitcoinmagazine.co….

---------------------Liked this article? Share it with others:

Follow Us for Latest News & Articles: