Today is Bitmain’s third anniversary and celebrations are underway at the Bitmain headquarters in Beijing while I start to round up some noteworthy bitcoin news of the past two weeks.

Bitcoin price crosses $700

Bitcoin price continued to flaunt its mojo since our previous bitcoin news’ roundup and crossed the $700 mark by the time of publishing this (29 October). This is the highest it has risen since 21 June 2016.

The strongest factor in this rise seems to be the devaluation of the Chinese Yuan. The graph below from a Bloomberg article shows an inverse relationship between the price of Chinese Yuan and that of Bitcoin.

MGT Capital Investments partners with Bitmain

On Wednesday, news that MGT Capital Investments, Inc. (OTC: MGTI) has signed a Letter of Intent (LOI) to form a joint venture with Bitmain became public with MGTI’s press release.

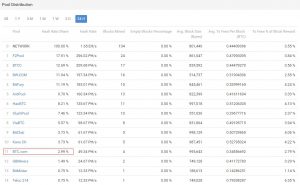

The proposed joint venture is expected to result in the development of a Bitcoin mining pool that will include advanced user interface as well as superior network protection and security maintained by MGT’s proprietary cybersecurity technologies. In addition, the companies plan to form a partnership to offer businesses and consumers affordably priced cloud mining contracts.

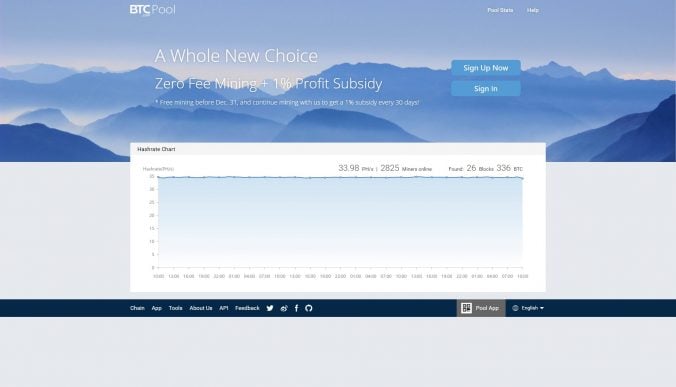

Bitmain’s BTC.com organizes the biggest conference for owners and operators of “mining farms”

On 22 October, Bitmain’s BTC.com held the first-ever conference for “mining farm” owners and operators in Chengdu, China. Kevin Pan of BTC.com introduced some unique aspects of its BTC.com mining pool while Chris Zhu of BTC.com explained how miners protect the bitcoin network. Further description of the event is on BTC.com’s blog post.

Kevin Pan of BTC.com at the miners’ conference in Chengdu

Hillary’s campaign team calls Bitcoin a “libertarian Ayn Rand schtick”

An email exchange published by WikiLeaks in which the Democrat presidential candidate Hillary Clinton’s campaign chairman John Podesta commented on bitcoin saw the media’s spotlight on 18 October. The email thread was started by Stan Stalnaker, founding director and chief strategy officer of the digital currency “Ven”, to propose Ven for use by Hillary’s campaign after meeting with Podesta at a Hillary fundraiser in London.

Podesta forwarded the email to campaign tech aide Teddy Goff with an explanation: “I don’t send all the crazy ideas I hear about at fundraisers your way, but this seems interesting and legit. Essentially digital currency with a green angle as opposed to bitcoin’s libertarian Ayn Rand schtick. Would you get some members of your team to meet with Stan when he’s in NYC later this month to see if it’s worth a real conversation?”

Liked this article? Share it with others:

Follow Us for Latest News & Articles: